Page 19 - INVESTMENT INCENTIVE MECHANISMS AND POLICIES

P. 19

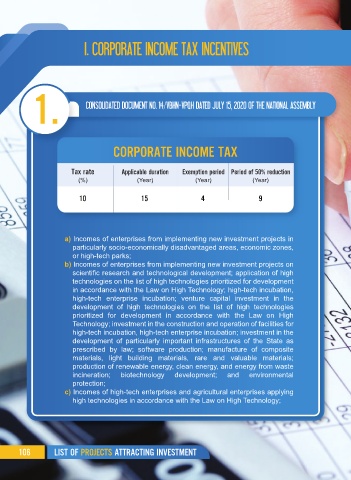

I. CORPORATE INCOME TAX INCENTIVES

1. CONSOLIDATED DOCUMENT NO. 14/VBHN-VPQH DATED JULY 15, 2020 OF THE NATIONAL ASSEMBLY

CORPORATE INCOME TAX

Tax rate Applicable duration Exemption period Period of 50% reduction

(%) (Year) (Year) (Year)

10 15 4 9

a) Incomes of enterprises from implementing new investment projects in

particularly socio-economically disadvantaged areas, economic zones,

or high-tech parks;

b) Incomes of enterprises from implementing new investment projects on

scientific research and technological development; application of high

technologies on the list of high technologies prioritized for development

in accordance with the Law on High Technology; high-tech incubation,

high-tech enterprise incubation; venture capital investment in the

development of high technologies on the list of high technologies

prioritized for development in accordance with the Law on High

Technology; investment in the construction and operation of facilities for

high-tech incubation, high-tech enterprise incubation; investment in the

development of particularly important infrastructures of the State as

prescribed by law; software production; manufacture of composite

materials, light building materials, rare and valuable materials;

production of renewable energy, clean energy, and energy from waste

incineration; biotechnology development; and environmental

protection;

c) Incomes of high-tech enterprises and agricultural enterprises applying

high technologies in accordance with the Law on High Technology;

106 LIST OF PROJECTS ATTRACTING INVESTMENT