Page 22 - INVESTMENT INCENTIVE MECHANISMS AND POLICIES

P. 22

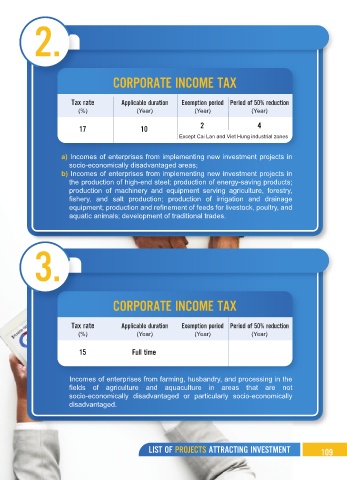

2.

CORPORATE INCOME TAX

Tax rate Applicable duration Exemption period Period of 50% reduction

(%) (Year) (Year) (Year)

17 10 2 4

Except Cai Lan and Viet Hung industrial zones

a) Incomes of enterprises from implementing new investment projects in

socio-economically disadvantaged areas;

b) Incomes of enterprises from implementing new investment projects in

the production of high-end steel; production of energy-saving products;

production of machinery and equipment serving agriculture, forestry,

fishery, and salt production; production of irrigation and drainage

equipment; production and refinement of feeds for livestock, poultry, and

aquatic animals; development of traditional trades.

3.

CORPORATE INCOME TAX

Tax rate Applicable duration Exemption period Period of 50% reduction

(%) (Year) (Year) (Year)

15 Full time

Incomes of enterprises from farming, husbandry, and processing in the

fields of agriculture and aquaculture in areas that are not

socio-economically disadvantaged or particularly socio-economically

disadvantaged.

LIST OF PROJECTS ATTRACTING INVESTMENT 109