Page 21 - INVESTMENT INCENTIVE MECHANISMS AND POLICIES

P. 21

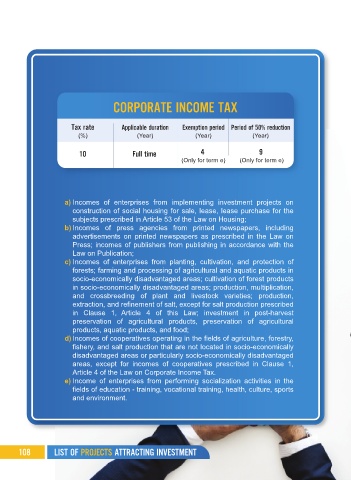

CORPORATE INCOME TAX

Tax rate Applicable duration Exemption period Period of 50% reduction

(%) (Year) (Year) (Year)

10 Full time 4 9

(Only for term e) (Only for term e)

a) Incomes of enterprises from implementing investment projects on

construction of social housing for sale, lease, lease purchase for the

subjects prescribed in Article 53 of the Law on Housing;

b) Incomes of press agencies from printed newspapers, including

advertisements on printed newspapers as prescribed in the Law on

Press; incomes of publishers from publishing in accordance with the

Law on Publication;

c) Incomes of enterprises from planting, cultivation, and protection of

forests; farming and processing of agricultural and aquatic products in

socio-economically disadvantaged areas; cultivation of forest products

in socio-economically disadvantaged areas; production, multiplication,

and crossbreeding of plant and livestock varieties; production,

extraction, and refinement of salt, except for salt production prescribed

in Clause 1, Article 4 of this Law; investment in post-harvest

preservation of agricultural products, preservation of agricultural

products, aquatic products, and food;

d) Incomes of cooperatives operating in the fields of agriculture, forestry,

fishery, and salt production that are not located in socio-economically

disadvantaged areas or particularly socio-economically disadvantaged

areas, except for incomes of cooperatives prescribed in Clause 1,

Article 4 of the Law on Corporate Income Tax.

e) Income of enterprises from performing socialization activities in the

fields of education - training, vocational training, health, culture, sports

and environment.

108 LIST OF PROJECTS ATTRACTING INVESTMENT