Page 23 - INVESTMENT INCENTIVE MECHANISMS AND POLICIES

P. 23

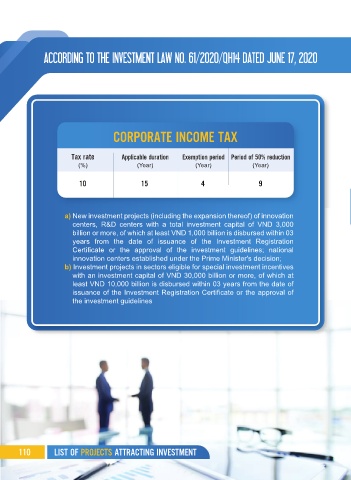

ACCORDING TO THE INVESTMENT LAW NO. 61/2020/QH14 DATED JUNE 17, 2020

CORPORATE INCOME TAX

Tax rate Applicable duration Exemption period Period of 50% reduction

(%) (Year) (Year) (Year)

10 15 4 9

a) New investment projects (including the expansion thereof) of innovation

centers, R&D centers with a total investment capital of VND 3,000

billion or more, of which at least VND 1,000 billion is disbursed within 03

years from the date of issuance of the Investment Registration

Certificate or the approval of the investment guidelines; national

innovation centers established under the Prime Minister's decision;

b) Investment projects in sectors eligible for special investment incentives

with an investment capital of VND 30,000 billion or more, of which at

least VND 10,000 billion is disbursed within 03 years from the date of

issuance of the Investment Registration Certificate or the approval of

the investment guidelines

110 LIST OF PROJECTS ATTRACTING INVESTMENT